Foreign Investment Climate in Bangladesh

Compiled from the Speech of a Former Director, FBCCI

Thank you for reading this post, don't forget to subscribe!

Bangladesh has liberalized its economy in keeping with the global trend. As an underdeveloped country she has to increase her production capacity rapidly to prepare herself for integration with free market economy by 2005. Bangladesh follows private sector-led growth economy, where the Govt. is the facilitator and private sector is the main player.

Bangladesh has been maintaining a steady economic growth of about 5% during the last ten years. There is a target to increase this growth rate at 5.7% in the next year and in medium-term 7%. In the year 2002-2003, the domestic savings rate was about 18.23%, GDP at current market price was about US $ 51.90 billion, annual per capita GDP US$ 389, growth rate 5.3%, industrial growth rate at constant price 6.62%, inflation rate: 5.2%, investment rate:23.2% of GDP.

In Bangladesh, sharp decline in the availability of Official Development Assistance (ODA) and limitations of capital formation and export earnings, the need for Foreign Director Investment (FDI) has become a major issue. Government policies tried to induce foreign investments not only for capital formation but also to acquire technology and management skills besides having access to the export markets. Bangladesh Govt. has been providing various type of incentives to the foreign investors. The balance of trade is always against Bangladesh. In 2002-03, Bangladesh export was only US$ 6548 million and import US$ 9658 million, the balance of trade being US$ 3110 million against Bangladesh. To reduce this trade gap, it is highly required to increase country’s industrial growth for enhancing its export earnings. Being deficient capital like many other developing countries, Bangladesh needs substantial foreign direct investment for attaining sustained economic growth along with for developing its industrial base and poverty reduction.

INCENTIVES AND FACILITIES FOR THE INVESTORS

To attract foreign direct investment, the Government of Bangladesh has offered most liberal package of investment facilities and incentives.

Tax holiday: Tax holiday facilities will be available for 5 or 7 years depending on location of the industrial enterprise. Tax holiday facilities will be provided in accordance with the existing laws.

Accelerated depreciation: Industrial undertakings not enjoying tax holiday will enjoy accelerated depreciation allowance. Such allowance is available at the rate of 100 per cent of the cost of the machinery or plant.

Concessionary duty on imported capital machinery: Import duty, at the rate of 5% ad valorem, is payable on capital machinery and spares imported for initial installation or BMR/BMRE of the existing industries.

Rationalization of import duty: Duties and taxes on import of goods which are produced locally will be higher than those applicable to import of raw materials for producing such goods.

Incentives to Non-Resident Bangladeshis (NRBs): Investment of NRBs will be treated at par with FDI. Special incentives are provided to encourage NRBs for investment in the country. NRBs will enjoy facilities similar to those of foreign investors.

Other incentives:

- Tax exemption on royalties, technical know-how fees received by any foreign collaborator, firm, company and expert.

- Tax exemption on the interest on foreign loans under certain conditions.

- Avoidance of double taxation in case of foreign investors on the basis of bilateral agreements.

- Exemption of income tax up to 3 years for the foreign technicians employed in industries specified in the relevant schedule of income tax ordinance.

- Tax exemption on income of the private sector power generation company for 15 years from the date of commercial production.

- Facilities for full repatriation of invested capital, profit & dividend

- 6 months’ multiple entry visa for the prospective new investors.

- Re-investment of repatriable dividend treated as new investment.

- Citizenship by investing a minimum of US$5,00,000 or by transferring US$10,00,000 to any recognized financial institution (non-repatriable).

- Permanent residentship by investing a minimum of US$ 75,000 (non-repatriable)

- Tax exemption on capital gains from the transfer of shares of public limited companies listed with a stock exchange.

- Special facilities and venture capital support will be provided to export-oriented industries under “Thrust sectors” .

There will be no discrimination in case of duties and taxes for the same type of industries set up by foreign and local investors and in the public and private sectors.

Incentives to export-oriented and export-linkage industries: Export-oriented industrialization is one of the major objectives of the industrial Policy 1999. Export-oriented industries will be given priority and public policy support will be ensured in this respect. An industry exporting at least 80% of its manufactured goods or an industry contributing at least 80% of its products as an input to finished exportable, and similarly, a business entity exporting at least 80% of services including information technology related products will be considered as an export-oriented industry. To make investment in 100 per cent export-oriented industries, the following incentives and facilities will be provided:

- Duty free import of capital machineries and spare parts upto 10 percent of the value of such capital machinery will continue.

- Existing facilities for Bonded Warehouse and back-to-back Letter of Credit will continue.

- The system for duty drawback will be further simplified and to this end, duty drawback will be fixed at a flat rate on exportable and potentially exportable goods. Exporter will receive duty drawback at a flat rate directly from the relevant commercial banks.

- The arrangement for providing loans up to 90 percent of the value against irrevocable and confirmed Letter of Credit/ Sales Agreement will continue.

- To ensure backward linkage, incentives will be extended to the “deemed exporters” supplying indigenous raw materials to export-oriented industries. Export-oriented industries including export-oriented RMG industries, using indigenous raw materials will be given facilities and benefits at prescribed rates.

- The export-oriented industries, further to the provisions of Bangladesh Bank foreign exchange regulations, will be entitled to receive additional foreign exchange, on case-to-case basis, for publicity campaign, opening overseas offices and participating in international trade fairs.

- The entire export earnings from handicrafts and cottage industries will be exempted from income tax. For all other industries, income tax rebate on export earnings will be given at 50 percent.

- The facility for importing raw materials, which are included in the banned/ restricted list, but required in the manufacture of exportable commodities, will continue.

- The import of specified quantities of duty-free samples for manufacturing exportable products will be allowed consistent with the prevailing relevant government policy.

- The local products supplied to local industries or projects against foreign exchange payment or foreign exchange L/C will be treated as indirect exports and be entitled to all export facilities.

- The Export Credit Guarantee Scheme will be further expanded and strengthened.

- 10 percent products of the enterprises, located in both public and private EPZs will be allowed to be exported to domestic tariff area against foreign currency L/C on payment of applicable duties and taxes.

- 100 % percent export-oriented industry outside EPZ will be allowed to sell 20% percent of their products in the domestic market on payment of applicable duties and taxes.

Apart from the above-mentioned facilities, other facilities announced and provided in the Export Policy will be applicable to export-oriented and export-linkage industries.

Export Processing Zones (EPZs)

Export Processing Zones are considered by the foreign investors as an ideal location for the export-oriented industries. In Bangladesh, the Export Processing Zones with necessary infrastructural facilities offer very attractive incentives. Export Processing Zones in Chittagong and Dhaka provide necessary fiscal, non-fiscal and infrastructure facilities for export-oriented enterprises. Four more Export Processing Zones in Mongla, Ishurdi, Comilla and Syedpur (Nilphamari) are under implementation.

EPZ IN THE PRIVATE SECTOR

The Government enacted “The Bangladesh Private Export Processing Zones Act 1996” allowing setting up of Export Processing Zones in the private sector with a view to attracting more investment especially foreign investment in the country. Accordingly, quite a good number of private EPZs have been registered. The first private EPZ by a Korean company in Chittagong has already been implemented.

Bilateral Investment Guarantee Agreement has been signed with a number of countries. Bangladesh is a signatory to the Multilateral Investment Guarantee Agency (MIGA), Overseas Private Investment Corporation (OPIC) of USA, International Centre for Settlement of Industrial Disputes (ICSID) and is a member of the World Intellectual Property Organization (WIPO). It has already signed agreements with a number of countries for avoidance of double taxation. Besides, Bangladesh enjoys quota free and duty free market access into EU, Canada, Japan, Australia and Norway. This offers a tremendous opportunity to the foreign investors to set up production facilities in Bangladesh targeting those lucrative markets.

Meanwhile the Govt. of Bangladesh is committed to increase trade related capacity including trade and investment infrastructure and she has improved infrastructure facilities and Utility Services, Road Transport, Railway, Airways, Marine Transportation, Electricity, Water and Sewerage, Gas, Telecommunication, Industrial land, etc.

POTENTIAL SECTORS FOR INVESTMENT

The major potential sectors including “Thrust Sectors” identified by the Bangladesh Government, which offer probable choices for investment are:

Textiles: Being labor-intensive it is the most comparative advantage sector in Bangladesh. The captive demand of over 2.5 billion meters of fabrics of the burgeoning ready-made garments industries which are currently being met from imports and domestic unmet demand of about 280 million meters offer enormous potential for setting up backward linkage industries. Composite textile mills with modern dyeing and finishing facilities have excellent prospects.

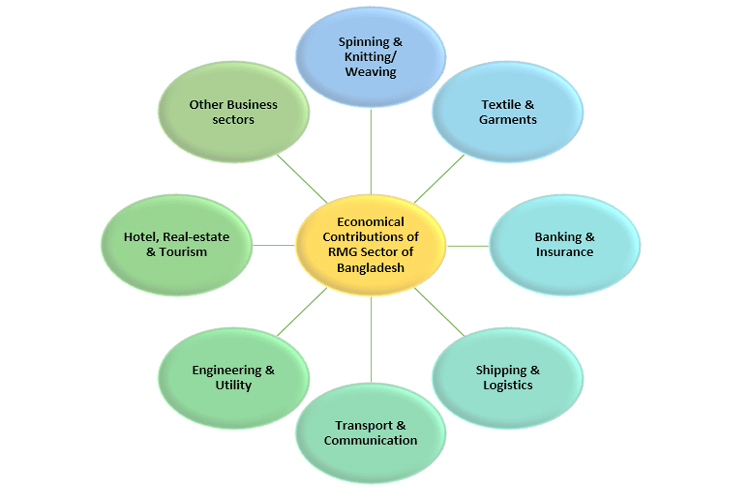

RMG and Knitwear: High fashion readymade garments (RMG) and knitwear are identified as thrust sector in Bangladesh. This sector has a great potential for FDI along with general RMG and knitwear.

Energy (Power Generation and Transmission): In view of the gradual widening of supply gap and pursuant to the policy of privatization the Government has recently opened the energy sector to private investment.

Natural Gas-based Industries: Bangladesh is endowed with large deposits of Natural Gas. Gas being the major source of energy for power generation, fertilizer factories, commerce, industries and domestic use, its exploration and development is a high priority for the country.

Telecommunication: The all-pervasive influence of the recent revolution in information technology on the telecommunication sector has opened up a new vista for private investment. This is a highly potential area not only because the possibilities and potentialities are immense, but also because there is a ready market of eager clients in the country.

Fisheries: There is large domestic demand for fish including shrimp & frozen fish and foreign markets are sizable and ever growing because of its proven superiority over meat proteins. Given extensive coastlines, large water bodies and excellent climatic conditions, the potential for fisheries development including hatcheries in Bangladesh is enormous.

Agro-based Industries: Bangladesh enjoys the basic attributes for successful agro-based industries namely, rich alluvial soil, a year-round frost-free environment, adequate water supply and an abundance of cheap labour. Increased cultivation of vegetables, tropical fruits, spices now grown in Bangladesh could feed agro-processing industries for both domestic and export markets. Floriculture can also be developed to meet export demand.

Electronics: Already a number of overseas electronics companies have established technical collaboration with Bangladeshi counterparts to produce electronic gadgets at competitive prices. But these are mostly assembling plants. The creation of feeder industries to supply parts such as transformers, fuses, printed circuit boards and coils to existing electronic operations has begun in a limited sale. The development and expansion of these and other areas offer large investment opportunities for the manufacture and export of electronic components and products.

Computer Software Development and Data Entry: The revolution in the information technology facilitating computerized global networking has opened tremendous opportunities for the highly lobour-intensive computer software development and data entry in Bangladesh. There is a large pool of educated girls and young man who can be easily trained to man these ventures.

Leather and Leather Goods: Bangladesh leather is of compact fiber structure and fine grains. Available quality hides can support a variety of increased value-added products such as jackets, garments, gloves, shoes, wallets, hand bags, watch bands etc.

Tourism: Tourism is another potential sector for foreign investment. There is the longest sea beach in Bangladesh and many other historical & attractive natural places have high potentials for investment.

Light Industries: Light industries of Bangladesh produce variety of labour-intensive goods including toys, consumer durables, small tools, and paper products for a large domestic market. Further development of these industries offers large investment opportunities. Some export oriented light industries have already been established by entrepreneurs from Hong Kong. Japan and Korea taking advantage of cheap and easily trainable local labour and available infrastructure facilities in EPZs. There are enormous potential for expansion of capacity in this sub-sector.

Besides, there are other potential areas for investment in Bangladesh, such as: light engineering, ceramic, dairy farming & dairy products, poultry farming & poultry products, jute goods, paper and pulp, cement, sheet and plate glass, etc. The government also welcomes investments in the development of port facilities and industrial parks.

Most of the foreign investors consider the investment potentials in Bangladesh to be bright and many of them would like to explore further the possibilities of investments either on their own or in partnership with local entrepreneurs and the incentives for foreign investors are quite attractive. They highly appreciate the policies of the present government for liberalization, private sector driven and market led growth in the economy.

Foreign Investment Climate in Bangladesh: Foreign Investment Climate in Bangladesh: Foreign Investment Climate in Bangladesh

Developing Bangladesh Md. Joynal Abdin Read More…

Social tagging: #Bangladesh Business Environment > #Bangladesh Economic Stability > #Bangladesh Investment Climate > #Bangladesh Investment Risks and Rewards > #FDI Environment Bangladesh > #Foreign Investment Opportunities Bangladesh > #Foreign Investor Confidence Bangladesh > #Investment Incentives Bangladesh > #Investment Policies Bangladesh > #Regulatory Framework for Foreign Investors > Foreign Investment in Bangladesh > investment > Investment Climate in Bangladesh

by

by